how is a reit taxed

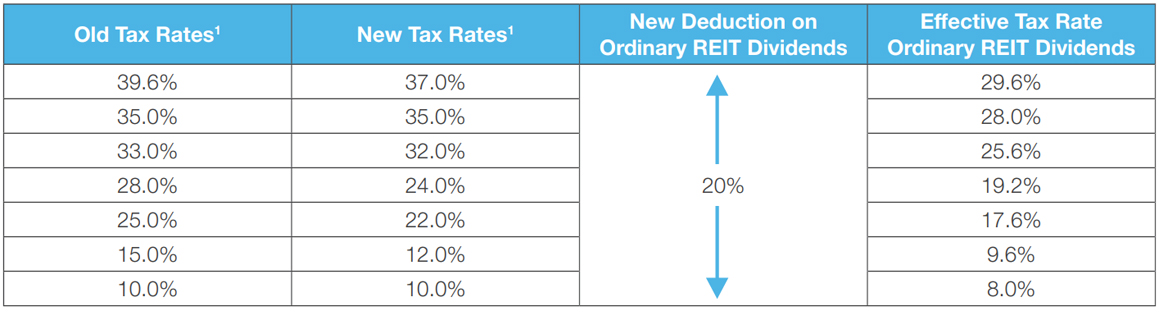

This income stream can surpass what is available in the fixed income. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate.

Should You Invest In Reits Ally

Ad Looking for a non-traded REIT.

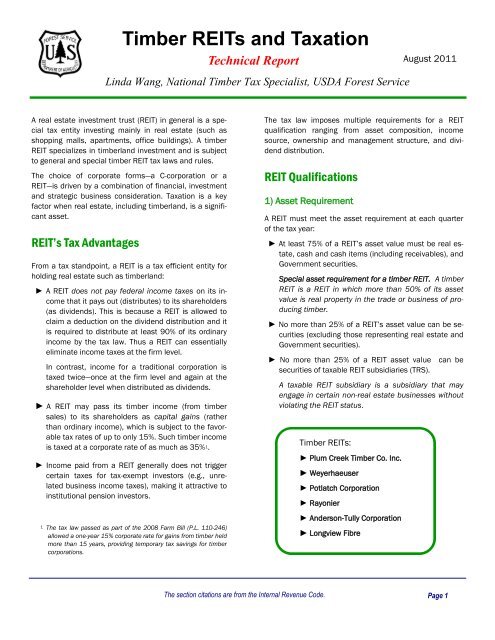

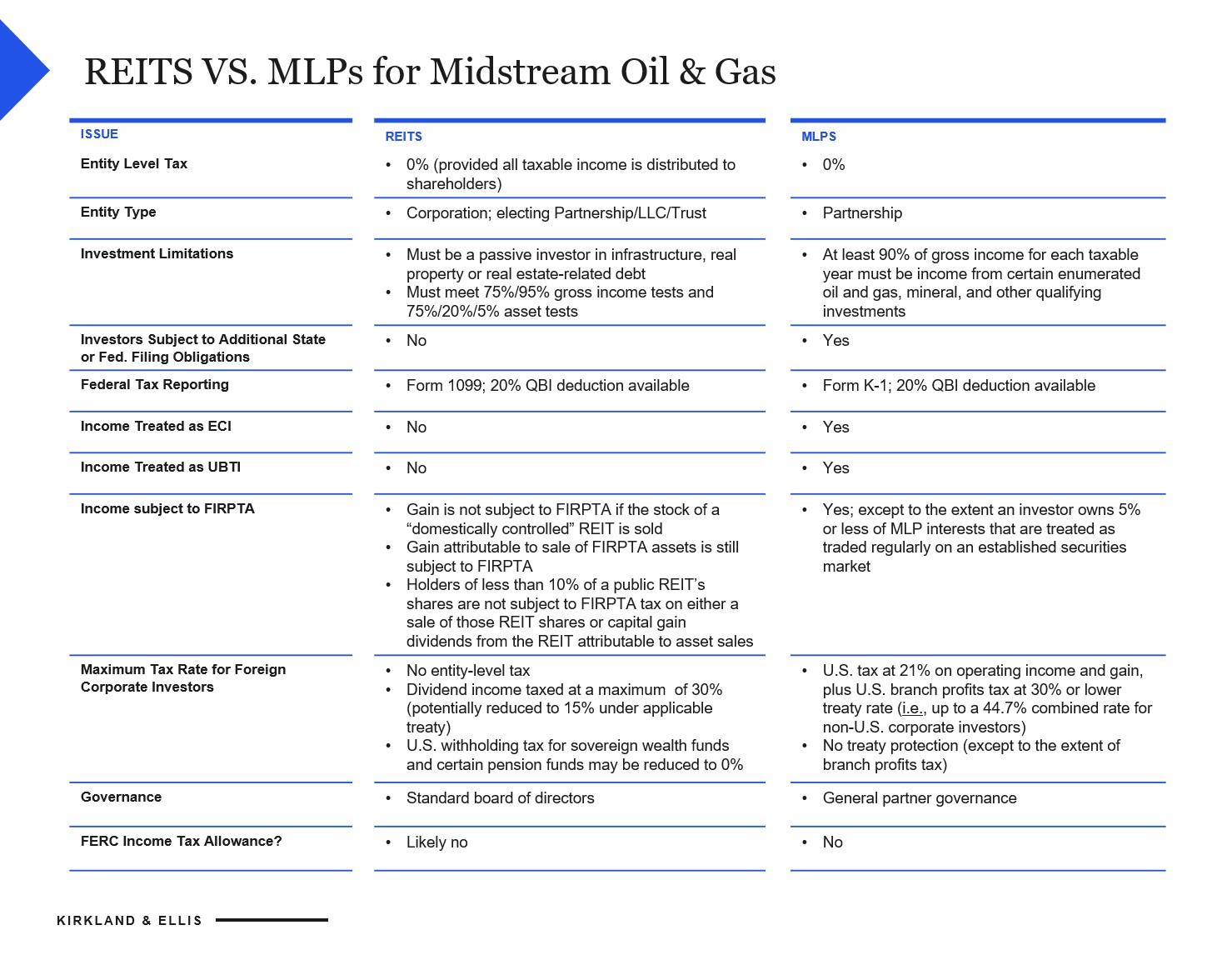

. REIT pronounced reet stands for Real Estate Investment Trust and since its inception in 1960 the sector has grown to be worth 45 trillion in the United States alone. Nonetheless a REIT may be subject to an entity-level tax on certain income such as REIT taxable income under section 857 a 1 alternative minimum tax built-in gains tax. To meet the definition of a REIT the bulk of its assets and income must come from real estate.

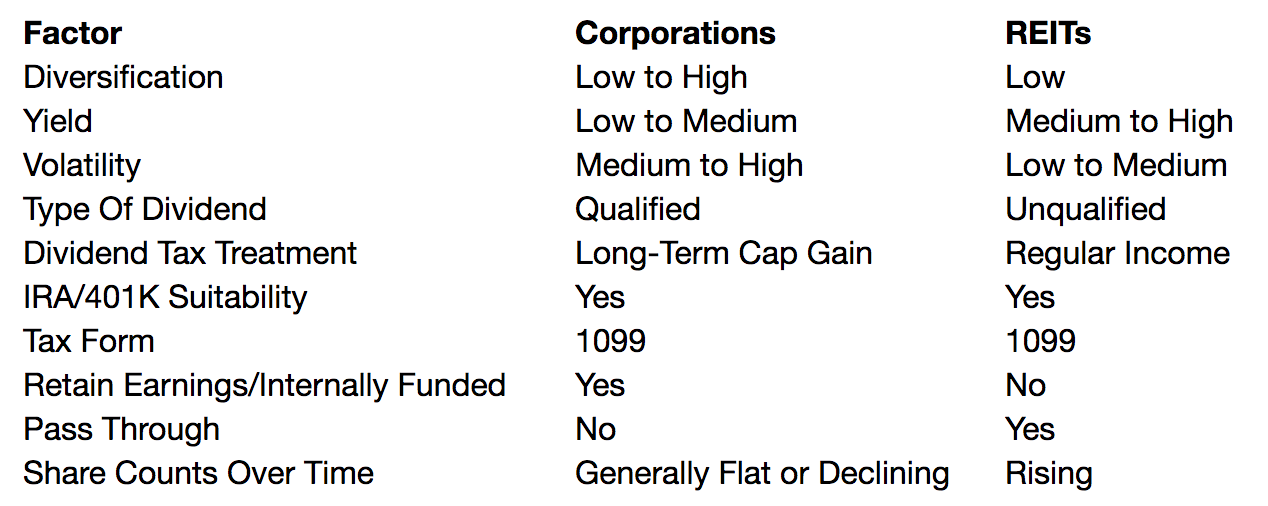

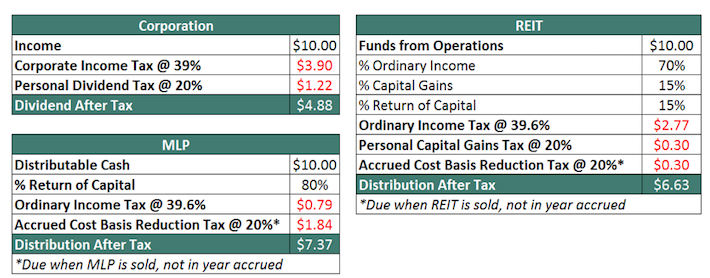

Ad Direxion Daily Real Estate Bull Bear 3X ETF. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status.

First a minimum of 75 percent of assets in a REITs investment portfolio must be directly connected to real estate. You will need to pay tax on any capital gains earned through the sale of. In order to qualify as a real estate investment trust the trust has to return a minimum of 90 percent of taxable income gained from income-producing.

Private Market Real Estate Opportunities. In addition it must pay 90 of its taxable income to shareholders. Rowe Price Has a Range of Solutions.

A taxable REIT subsidiary TRS is a corporation that is owned directly or indirectly by a REIT and has jointly elected with the REIT to be treated as a TRS for tax. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Secondly the REIT must distribute a minimum of 90 percent.

Rowe Price Has a Range of Solutions. Your REIT ETF company will send you a 1099-DIV form so you can report your dividends and earnings to the IRS. C-REIT makes building a commercial real estate portfolio easy with just one investment.

Ad A smarter way to execute your indexed annuity strategy. Nonetheless a REIT may be subject to an entity-level tax on certain income such as REIT taxable income under section 857 a 1 alternative minimum tax built-in gains tax personal holding. The Pros and Cons of Buying Stock in Real Estate Investment.

If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20. Box 1a shows your ordinary dividends or total dividends. Ad The Power of Over 85 Years of Investing Experience On your Side.

The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. However thanks to the Tax Cuts and Jobs Act REIT investors may be able to take advantage of the new 20 tax deduction for pass-through income which includes REIT. Build a private real estate portfolio with C-REIT.

Box 1 of the 1099-DIV where a REIT reports such dividends has two parts. Challenge the Old Buy Hold. This requirement means REITs typically dont pay corpora See more.

Posted by Grace Copeland on Dec 1 2021. Second your REIT can also provide you with. Ad Whats a REIT or Real Estate Investment Trust.

Corporation taxpayers will be subject to tax. Ad The Power of Over 85 Years of Investing Experience On your Side. Because of this you could be taxed as much as 37 on REIT dividends depending on your tax bracket.

REITs offer many tax advantages that can translate into a solid consistent stream of income for private REIT investors. REIT investors can deduct up to 20 of ordinary dividends before. These will normally be taxed at your regular.

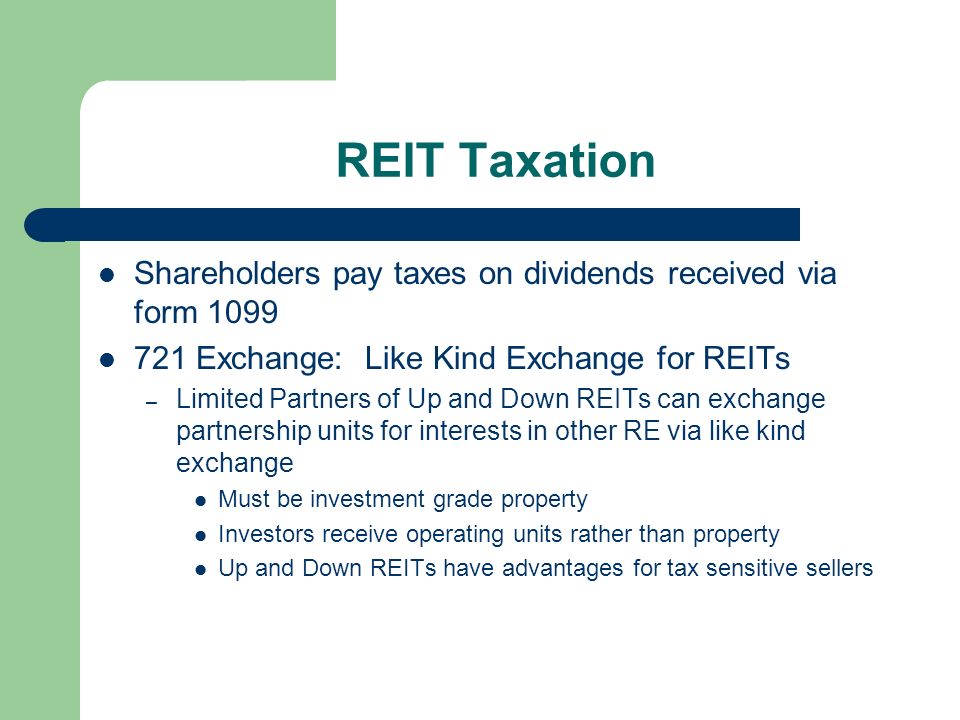

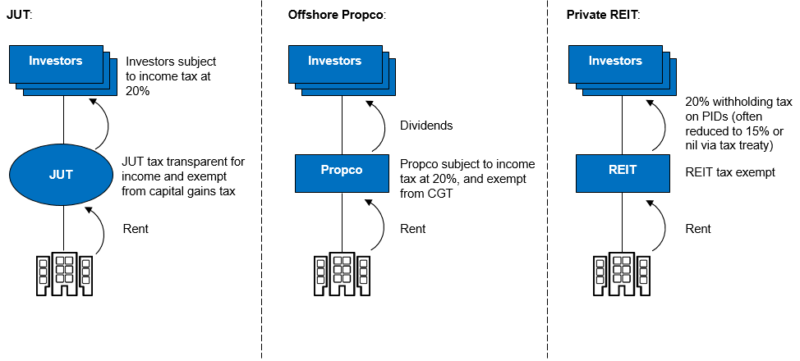

UK-resident individuals will be subject to income tax on PIDs at the normal rate of income tax with a current maximum rate of 45. In exchange for paying out at least 90 of taxable income to shareholders REITs.

Reit Vs Real Estate Syndications Goodegg Investments

Timber Reits And Taxation A Technical Report Timber Taxes

A Short Lesson On Reit Taxation

The Most Important Metrics For Reit Investing

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Should You Invest In Reits Ally

How To Value Reits In 2022 Real World Examples

Session Plan Chapter Twelve Reits As Investment Alternative Ppt Download

Midstream Reit Guidance Creates Opportunities For Midstream Oil Gas Publications Kirkland Ellis Llp

Understanding How Reits Are Taxed

The Continuing Rise Of The Reit

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Understanding The Reit Taxation Rules Novel Investor

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

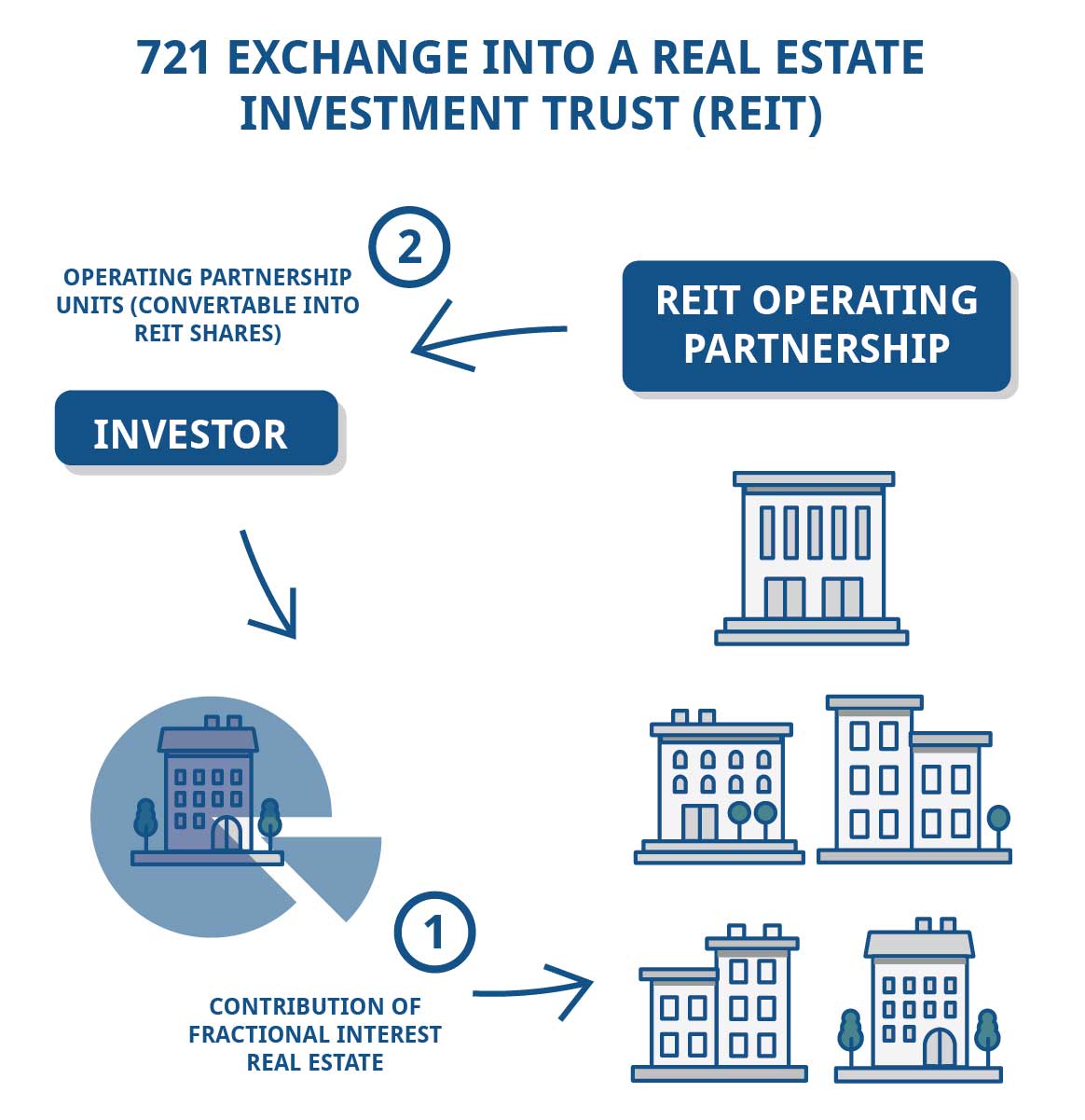

Introduction To The 721 Exchange Jrw Investments

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

A Guide To Reit Taxation Dividendinvestor Com

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint